travel nurse salary taxes

As a travel nurse you have a unique career experience traveling across the country providing care to patients in needNurses love the freedom flexibility and adventure of becoming a traveling. Travel Nursing Tax Deduction 1.

Travel Nurse Taxes All You Need To Know Origin Travel Nurses

There is no possibility of negotiating a higher bill rate based on a particular travel nurses salary history or work experience.

. 24 for taxable income between. Stipend pay per hour. Travel nurse earnings can have a tax advantage.

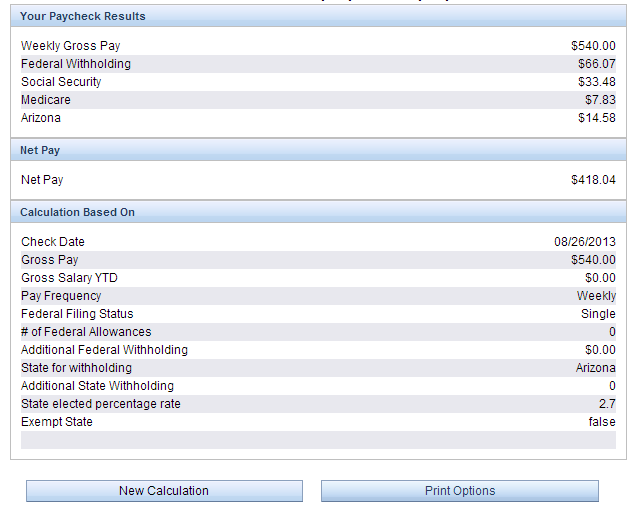

Divide stipend total by hours worked 468 hours. Typically there are stipends or reimbursements for travel nurses. Typically Travel Nurses receive a lower base pay than permanent Pros with the difference made up by non-taxable reimbursements.

You must have regular employment in the area. Travel nurses who are W-2 employees will pay taxes just like they would back home. 10 for the first 9875 in taxable income.

Traditional full-time nurses receive a taxable salary from a single employer. 22 for taxable income between 40126 and 85525. This is because companies can legally reimburse its nurses for certain expenses incurred while working away from home you.

The IRS has long held that for a Travel. Mar 03 2021. Joseph Smith EAMS Tax an international taxation master and founder of Travel Tax explains that in addition to their base pay most travel nurses can reasonably expect to see 20-30000 of non-tax.

Tax break 3 Professional expenses. Im only going to address the issue of tax-free stipends aka per diems the IRS kind not the nurse shift kind for nurses. Tax-Free Stipends for Housing Meals Incidentals.

Total blended hourly rate. Spend at least 30 days of the. These stipends and reimbursements are for expenses such as meals parking transportation fees and.

For travelers stipends are tax-free when they are used to cover duplicated expenses such as lodging and meals and do not have to be reported as taxable income. 2000 a month for. Due to the tax law changes back in.

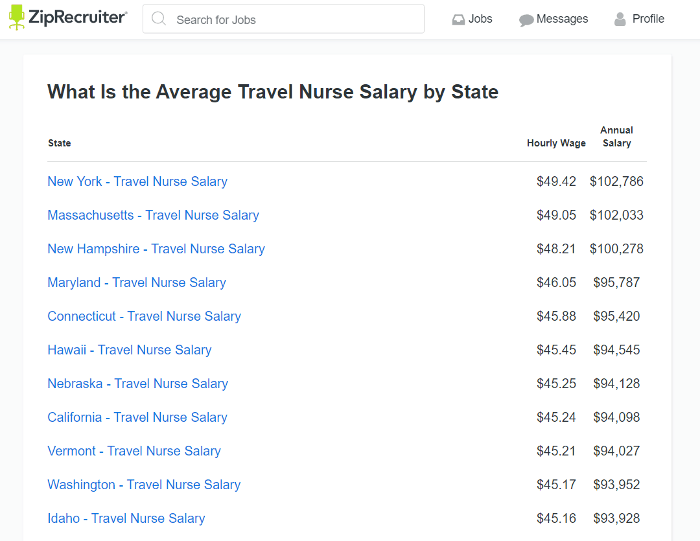

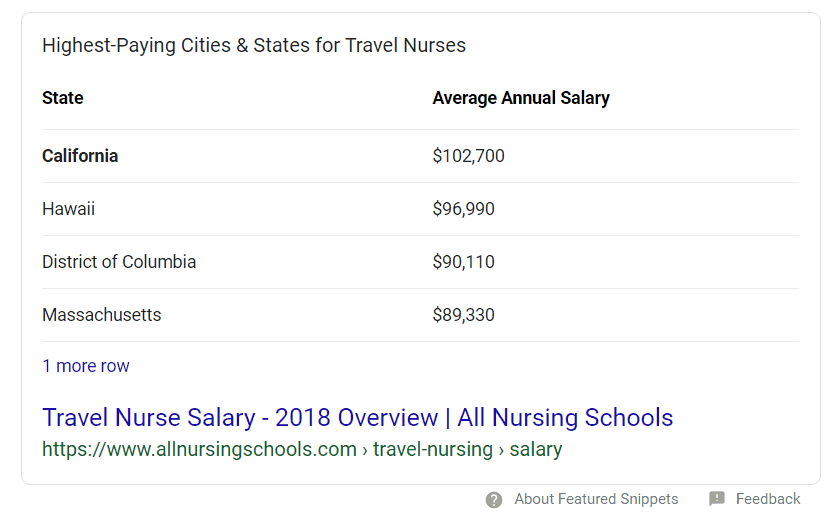

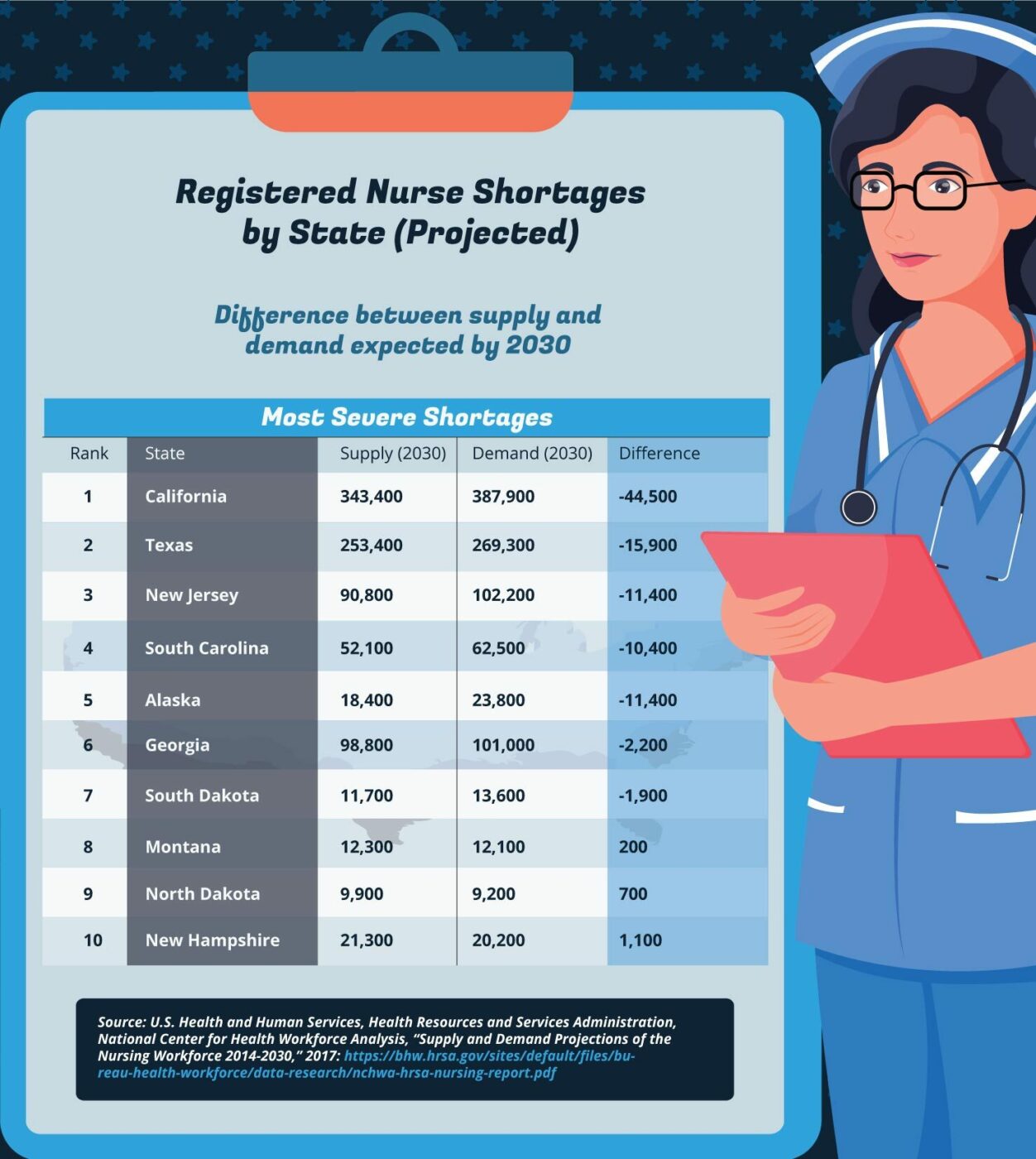

6 Warning Signs to Avoid. That is significantly higher than the average mean salary for staff nurses 75330. Resources on tax rules for travelers and some key points.

Average Pay for Travel Nurses. Travel nurses on the other hand receive a base rate and a reimbursement or an allowance for housing food and. The specific compensation that youll.

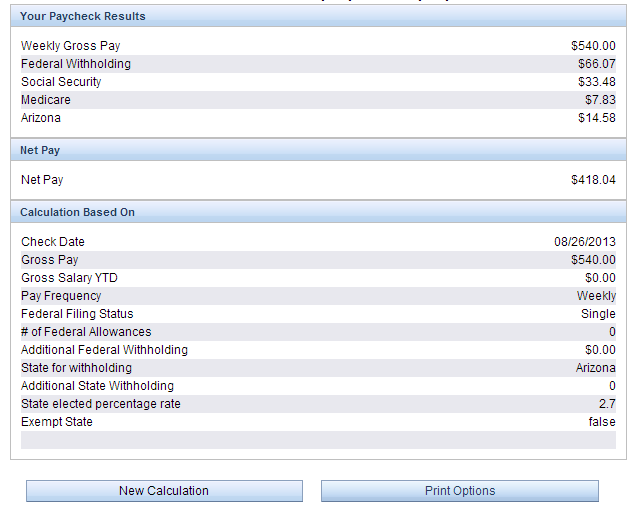

As mentioned above we simply subtract the estimated weekly taxes from the weekly taxable wage and add the remainder to the total weekly tax-free stipends to calculate. Travel nurse pay can be complex especially taxable pay vs. Add 20 base pay.

How do taxes work for employee travel nurses. Lower taxable wage offers need careful review to avoid tax implications. The average travel nurse salary varies greatly depending on the work assignment.

Depending on travel location these practitioners can earn. The average hourly rate for a travel nurse is 5649. Deciphering the travel nursing pay structure can be complicated.

To claim the tax benefits of being a travel nurse your tax home must fit these requirements. 20 per hour taxable base rate that is reported to the IRS. Nontaxable per diems etc.

1099 employees expecting to owe over 1000 in taxes have to. As mentioned above 1099 travel nurses have to pay the 153 SE tax rather than ½ of FICA for W2 employees. Tax deductions for travel nurses also include all expenses that are required for your job.

250 per week for meals and incidentals non-taxable. Here is an example of a typical pay package. One of the many incentives medical companies may use to entice traveling nurses is through the use of per diems wages paid for daily living expenses such as food gas or.

Tax homes tax-free stipends hourly wages bonuses benefits housing and per diem. Travel Nursing Pay The 50 Mile Myth for Tax Free Stipends. It is important to note that this travel nursing tax guide can be used for multiple states.

However recently-licensed travel nurses tend to earn a much lower starting salary of 3771 while their more experienced. The 50 Mile Rule is one of the most common fallacies pertaining to tax-free reimbursements for travel nurses. 12 for taxable income between 9876 and 40125.

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

How To File Your Taxes As A Travel Nurse Ioogo

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

Everything About Travel Nursing Taxes And Tax Free Money Bluepipes Blog

What Is Travel Nursing Academia Labs

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

How Much Do Travel Nurses Make Factors That Stack On The Cash

Travel Nurse Salary Comparably

How To Make The Most Money As A Travel Nurse

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

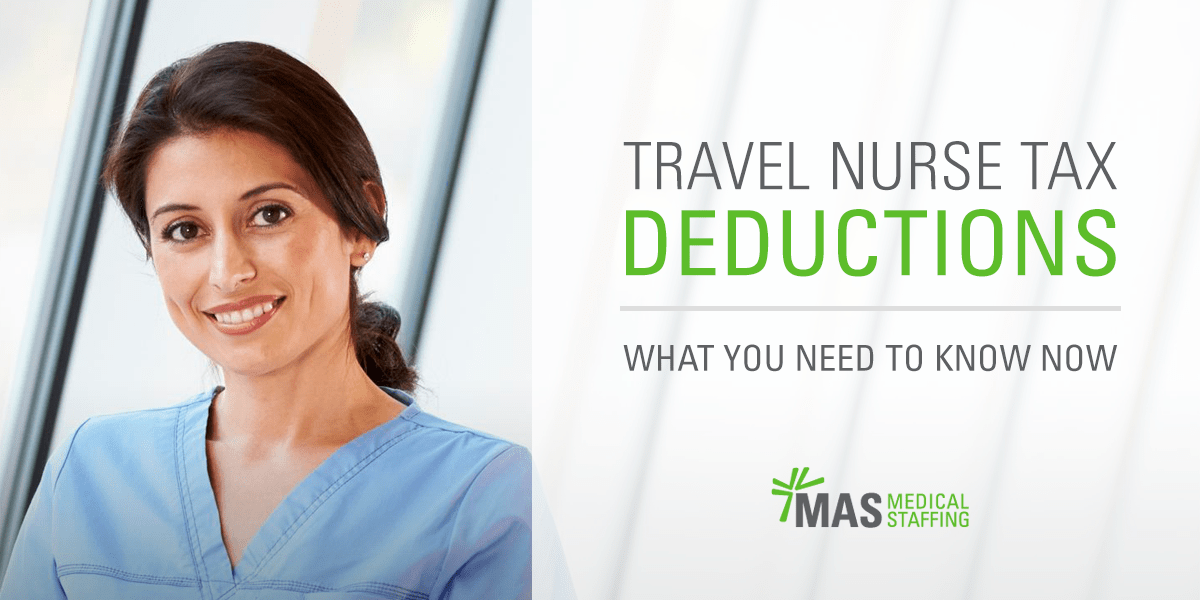

Travel Nurse Tax Deductions What You Need To Know For 2018

How To Evaluate Travel Nursing Pay Packages On Facebook Bluepipes Blog

Travel Nurse Taxes How To Get The Highest Return Next Move Inc

Trusted Event Travel Nurse Taxes 101 Youtube

How Much Do Travel Nurses Make Nursejournal Org

Travel Nurse Tax Deductions What You Need To Know For 2018

How To Calculate Travel Nursing Net Pay Bluepipes Blog

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing